Operativo mundial contra red de malware peligroso

Las agencias policiales y judiciales de la Unión Europea —Europol y Eurojust— dijeron el miércoles que los investigadores tomaron el control de la infraestructura detrás de una botnet llamada EMOTET. Una botnet es una red de ordenadores secuestrados que se utilizan para llevar a cabo ciberataques.

Las autoridades de Alemania, Canadá, Estados Unidos, Francia, Holanda, Lituania, Reino Unido y Ucrania participaron en la operación internacional coordinada por las agencias Europol y Eurojust, con sede en La Haya.

Los fiscales holandeses dijeron que el malware se descubrió por primera vez en 2014 y que “evolucionó hasta convertirse en la solución de referencia para los ciberdelincuentes a lo largo de los años”. La infraestructura de EMOTET actuaba esencialmente como una llave de acceso a los sistemas informáticos a escala global, de acuerdo con las autoridades.

Los fiscales holandeses dijeron que dos de los principales servidores de la infraestructura estaban ubicados en Holanda y un tercero en otro país no revelado. La fiscalía dijo que el daño causado por EMOTET asciende a cientos de millones de euros.

El software malicioso se instalaba a través de archivos adjuntos en correo electrónicos infectados que contenían documentos de Word.

“Se utilizaron una variedad de diferentes señuelos para engañar a los usuarios desprevenidos para que abrieran estos archivos adjuntos maliciosos”, dijeron los fiscales holandeses en un comunicado. “Anteriormente, las campañas de correo electrónico de EMOTET también se presentaban como facturas, avisos de envío e información sobre el COVID-19.

Europol dijo que las agencias policiales se unieron para derribar la infraestructura criminal desde su interior.

No es la primera vez que las autoridades infiltran operaciones informáticas ilícitas. En 2017, la policía cerró el principal mercado mundial de la llamada “darknet”. Posteriormente, la policía holandesa se apoderó silenciosamente de un segundo mercado para recaudar información sobre los vendedores y compradores de drogas ilícitas.

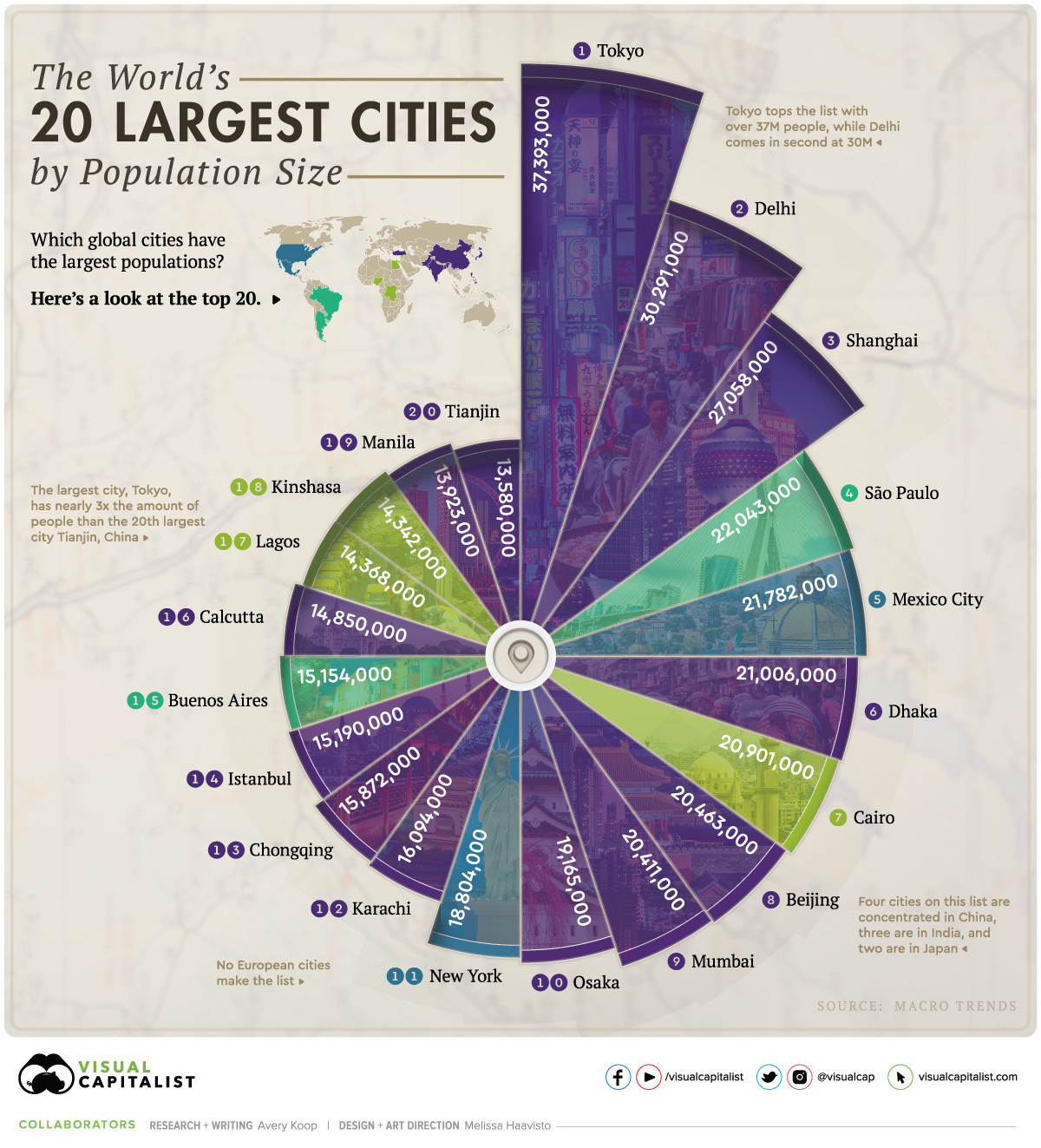

Las 20 ciudades más pobladas del mundo

| Rank | City | Population |

|---|---|---|

| 1 |  Tokyo Tokyo | 37,393,000 |

| 2 |  Delhi Delhi | 30,291,000 |

| 3 |  Shanghai Shanghai | 27,058,000 |

| 4 |  São Paulo São Paulo | 22,043,000 |

| 5 |  Mexico City Mexico City | 21,782,000 |

| 6 |  Dhaka Dhaka | 21,006,000 |

| 7 |  Cairo Cairo | 20,901,000 |

| 8 |  Beijing Beijing | 20,463,000 |

| 9 |  Mumbai Mumbai | 20,411,000 |

| 10 |  Osaka Osaka | 19,165,000 |

Elogio de la dimisión

Arias Navarro había sido designado presidente del Gobierno por Franco tras la violenta muerte de Carrero Blanco en 1973, y tras la muerte de su mentor, en su ya célebre discurso lloriqueante, se autoproclamó albacea testamentario del dictador. En esta línea, ni siquiera se planteó la posibilidad de ser sustituido como presidente del Gobierno, ya que el mandato de Franco era que él dirigiera el gobierno de España hasta enero de 1979. Sin embargo, a pesar del crítico juicio que la Historia hace de él, fue capaz de dimitir contra sus propias convicciones al comprobar que el nuevo jefe de estado, el rey Juan Carlos I, no le quería en el cargo. Sorprende que pocos sepan que nadie, si él no se hubiera ido voluntariamente, podía legalmente echarle.

No es el único caso de nuestra Transición. Cuando el Rey, maniobrando hábilmente con el Consejo del Reino para que entre los 3 propuestos para su aprobación estuviera su elegido sin dejar entrever que era su candidato, designó como jefe de gobierno a Adolfo Suárez, éste diseño una Ley para la Reforma Política. Pero dicha ley debía ser votada en las Cortes franquistas, que si la aprobaban estaban haciéndose un “harakiri” ya que significaba su disolución y el fin de la carrera política de la mayoría de sus miembros. Pues a pesar de esto, las Cortes franquistas votaron por su propia dimisión y aprobaron la ley por 425 votos a favor, 13 abstenciones y sólo 59 en contra.

Entiendo que es difícil ser consciente uno mismo que sobra, convencerse de que hay que dejar el puesto de poder para volver a una vida cotidiana, por eso elogio la dimisión como concepto, aunque sea de personas tan diferentes y por motivos tan dispares como Pinochet –que seguramente creyó iba a ser elegido en las elecciones- o Fidel Castro –que probablemente esperaba sanar y volver a tomar las riendas. Desde luego en España tenemos un ejemplo admirable en la figura de Aznar, que puede ser discutido por muchos motivos, pero al que hay que reconocer que no sólo cumplió su palabra –de irse-, algo muy difícil de ver en un político, además se largó en un momento en el que las encuestas le otorgaban un tercer mandato y en el que su poder, con una cómoda mayoría absoluta parlamentaria, no era discutido.

Como vemos, es rara la dimisión, y estoy convencido que es digna de elogio y me parece injusto que la Historia no remarque a los que se fueron voluntariamente, de los que facilitaron con su ausencia lo que otros consiguieron con su presencia. Y pienso que el gran público debería valorar en su justa medida a los que saben irse, aunque puede –volviendo a Aznar- que después se arrepientan, que ese es otro tema. Prácticamente nadie valora esa labor de personas que voluntariamente decidieron perder su poder para dejar a otros la oportunidad. No hace muchos años a muchos les parecía correcto que Juan Pablo II no dimitiera aunque ya no le quedaban fuerzas pero luego se aplaudió la actitud mucho más humilde de Ratzinger….

Quizás si estuviera mejor vista socialmente, la dimisión sería mucho más frecuente, algo que creo podría ser muy beneficioso para el mundo.

Luchar contra la Tasa Tobin puede salir más caro que abonarla

En la imagen se puede apreciar la evolución los últimos años de la capitalización bursátil de varios índices de la Eurozona. A más de uno seguro le sorprende que el CAC francés sea más grande que el Dax (aunque en derivados el Dax sea mucho más popular entre los traders) y también se puede apreciar lo pequeño que es el mercado europeo, Apple por ejemplo vale tanto en bolsa como la suma de todo el mercado español y francés junto. Pero a mi lo que más me llama la atención es que hace tan sólo tres años, el Ibex capitalizaba lo mismo que el índice de la bolsa holandesa y hoy es casi la mitad. Y eso que estos años la economía española ha crecido más que la holandesa, otra prueba de que el valor de las cotizadas no tiene por qué estar en relación con los datos macroeconómicos de un país.

Es evidente la decadencia de nuestro mercado bursátil nacional. Para colmo, inventos como la Tasa Tobin pueden reducir aún más el volumen de negociación y el interés por los principales valores del Ibex, otro motivo más para buscar el negocio en otros mercados. Sin embargo, habrá quien se decante por buscar valores españoles más pequeños, de menor capitalización, para así esquivar tener que pagar este absurdo impuesto. Es lógico buscar pagar menos tasas, todos lo hacemos pero debemos comprobar si por buscar un valor menos líquido lo que nos ahorramos por un lado lo perdemos por otro si el spread (diferencia entre precio de compra y venta) es mayor que en Inditex, por ejemplo.

Es comprensible buscar ahorrar costes (no sólo por esto, también en comisiones y gastos de custodia, tanto si se invierte como si se especula) pero siempre hay que tener en cuenta que cuanto menor es el volumen de una acción, más erráticos pueden ser sus movimientos y además más manipulables. Y esto podría llevar a que nuestro sistema no funcione tan afinadamente. En cualquier caso, mi consejo es que si se ve una oportunidad, hay que ir a por ella. Y personalmente no me frenará la tasa Tobin aunque mi recomendación es explorar otros mercados más allá del nacional.

Por último, tampoco parece buena opción pasarse a operar en un instrumento de tanto riesgo como los CFDs (en el que el 80% de sus participantes pierde dinero según comunican -obligados por la normativa- los propios brókers que ofrecen este producto derivado) porque -absurdamente, ya que son bastante más especulativos que la operativa en acciones- no hay que pagar la tasa Tobin si se opera con ellos. Los CFDs con un instrumento de tráding estupendo, mi favorito pero definitivamente exige una experiencia operativa (especialmente psicológica) muy necesaria debido a que el apalancamiento puede generar unas pérdidas muy duras.

Empatía

El que creo es el mejor director de cine canadiense (aunque nació en Egipto) de la historia, Atom Egoyan, es de origen armenio. Quizás ello le llevó a realizar una película que entre otros muchos temas -y bajo una estructura argumental muy buena, a la altura de su calidad- abordó el genocidio armenio iniciado en 1915: Ararat. Para quien no conozca aquel episodio y en breves palabras, diré que el gobierno turco trató de aniquilar (a través de deportaciones y asesinatos, además de torturas y violaciones) a los turcos de origen armenio –en torno al millón- con la excusa de la Primera Guerra Mundial y el miedo a que apoyaran al enemigo ruso. Hay mucha información en la red sobre este asunto para quien le interese.

La pregunta obvia es: ¿Por qué nos debería interesar unos hechos que pasaron hace más de 100 años en un lugar tan lejano? Como historiador que soy creo la respuesta es muy obvia: aprendiendo de la Historia nos conocemos mejor y eso nos puede ayudar a resolver nuestros problemas, tanto presentes como futuros. Y es que hay una anécdota que dice que un general –sólo un militar se atrevería probablemente a hacerle alguna objeción- le preguntó a Hitler acerca de su plan de exterminio de judíos: “¿Y cómo cree que reaccionará la comunidad internacional, cree que se quedarán de brazos cruzados viendo cómo los vamos eliminando?” a lo que el cruel dictador respondió: “¿Acaso alguien hizo algo a favor de los armenios, acaso alguien recuerda el genocidio armenio, acaso no acabaron impunes sus responsables?”

Hará unos años vi una película de inferior calidad (“Hotel Rwanda” de Terry George) ambientada en el “Genocidio de Ruanda” entre hutus y tutsis. Me sorprendió porque era muy crítica con la falta de intervención internacional para frenar el desastre, tema un poco delicado ya que puede volverse contra los que están en contra de otras intervenciones como Irak y Afganistán. El caso es que ha sido olvidado a pesar de la cercanía temporal (1994), como casi todo lo que ocurre en África (aunque los antropólogos insisten que la historia de la vida humana sobre el planeta existió sólo en aquel continente durante 700 mil años antes de difundirse a otros lugares). Y muy cercano a aquellos hechos (1991) en nuestra Europa Serbia intentó una limpieza étnica (otra forma de llamar al genocidio) contra los bosnios. Otra vuelta de rosca que nos lleva de nuevo a Irak y Afganistán ya que sólo USA ayudó a los bosnios (musulmanes agredidos por católicos) y contra el criterio de la ONU movilizó a la OTAN e inició una guerra tan “ilegal” –hubo veto ruso a la intervención en el Consejo de Seguridad por lo que teóricamente no se debía haber hecho- como lo fue la de Irak.

Para mi el asunto de intervenir o no ante una flagrante violación de derechos humanos no tiene duda: todos somos la misma raza y los derechos individuales siempre van a estar por encima de las leyes internacionales o las leyes soberanas de cada país, pero reconozco que abrir la puerta a ello sería muy peligroso, es por eso que abogo por unas leyes internacionales que sean supranacionales y que exista un mínimo de derechos humanos que deben ser cumplidos obligatoriamente bajo amenaza de intervención. Utopía de momento, ya que el coste de una política así sólo parecen estar dispuesto a asumirlos los EUA y defienden antes sus intereses que los de la humanidad. El caso es que nuestro conocimiento del pasado de la Humanidad debe ser una ayuda para que al menos no permitamos se repitan los mismos errores. Cambien o no las actitudes de los países y las leyes del planeta, el poder conocer con rigor y libertad nuestra Historia sería ya una gran victoria…para la raza humana.

Y desde luego para prevenir nuevos genocidios no podemos dejar impunes los que ha habido, debemos insistir en que la justicia actúe para que ningún implicado quede libre de su crimen. Y si los culpables ya han muerto, que al menos conozcamos lo que pasó, que conozcamos nuestra historia, de lo que los seres humanos hemos sido capaces, lo bueno y lo malo pues nada nos es ajeno. Lo que somos y lo que seremos está en lo que hemos hecho y en cómo hemos actuado ante lo que hemos hecho. El que ningún dolor nos deje indiferentes será el primer paso para que todos nos sintamos orgullosos de ser lo que somos: humanos.

Colección de citas de economía y mercados (en inglés)

My favorite time frame for holding a stock is forever. - Warren Buffett

I put heavy weight on certainty. It's not risky to buy securities at a fraction of what they're worth. - Warren Buffett

You must never confuse genius with a bull market. - Nick Leslau

Financial capacity and political perspicacity are inversely correlated. - John K. Galbraith

People who look for easy money invariably pay for the privilege of proving conclusively that it cannot be found on this sordid earth. - Edwin Lefevre

All nations with a capitalist mode of production are seized periodically by a feverish attempt to make money without the mediation of the process of production. - Karl Marx

Long periods of prosperity usually end in scandal. - George Taucher

There is something about inside information which seems to paralyse a man's reasoning powers. - Bernard Baruch

People forget that today's junk is often tomorrow's blue chip. - Mike Milken

When you see business execs helicoptering to the golf course, waiters discussing the merits of Intel versus Applied Materials, 22-year-olds in suspenders smoking cigars and drinking Martinis, and houses in the suburbs selling way over the asking price - then you know that the referee has brought the whistle to his lips and is about to blow. The game is nearly over. - James K. Glassman

I don't think of myself as a criminal. I was trying to correct a situation. And however naive and stupid this might sound, I was always working in the best interests of the bank. - Nick Leeson

There is perhaps no record of a bank fraud existent of which the perpetrator was not honest yesterday. - James S. Gibbons

Because we're independent, people come to us when they're in trouble. They come to auntie and auntie helps them. They find us wise, sympathetic and helpful - but not rich. - George Blunden

A bank lives on credit. Till it is trusted it is nothing; and when it ceases to be trusted it turns to nothing. - Walter Bagehot

If we close a bank every time we find an example or two of fraud we would have rather fewer banks. - Robin Leigh-Pemberton on the BCCI scandal

Americans are still reasonably parochial. They'd rather make a bad loan in Texas than a good loan in Brazil. - Walter Wriston

It's so expensive to be rich. - Susan Gutfreund

If you don't have some bad loans you are not in business. - Paul Volcker

One of the things investors have learned about emerging markets recently is that they are hard to emerge from in an emergency. - Robert Hormats reflecting on the economic crisis in Mexico in 1995

A billion dollars isn't what it used to be. - Nelson Bunker Hunt whose family incurred debts of $1,825 million after failing to corner the silver market in the 1980s

Capitalism without bankruptcy is like Christianity without Hell. - Frank Borman

We pay the debts of the last generation by issuing bonds payable by the next generation. - Lawrence J. Peter

A remarkably large part of any rescuer's time is taken up in coping with, some would say, fighting off, the very same banks whose money the rescuer is trying to recover. - Lewis Robertson

It is unanimously and without qualification assumed that when anyone gets into debt, the fault is entirely and always that of the lender and not the borrower. - Bernard Levin

Debt isn't good, debt isn't bad. To put it in the extreme, for some companies no debt is too much leverage. For others a debt of 100% can easily be absorbed. People assume the capital structure of a company is burned in stone. The capital structure, like the individual, is constantly changing. - Mike Milken

No country has ever been ruined on account of its debts. - Adolf Hitler

Blessed are the young, for they shall inherit the national debt. - Herbert Hoover

I've never been able to understand how the Democrats can run those $1,000-a-plate dinners at such a profit and run the government at such a loss. - Ronald Reagan

The era of extravagance and insanity has come to an end. This is a breath of fresh air. Drexel got what it deserved. These guys could destroy the country. There was no rhyme or reason for what was going on. - Pierre Rinfret on the demise of Drexel Burnham Lambert

Money is lacking? Well then, create it! - Goethe

The louder he talked of his honour, the faster we counted our spoons. - Ralph Waldo Emerson

In white collar situations, they don't think of themselves as thoroughgoing criminals, so when they get caught there's a level of guilt involved. Suddenly there is a conflict between what they appear to families, friends, co-workers, and what they are doing in the secret part of their life. It tends to move them towards confessing, putting it all behind them. They haven't acquired the ethics of organised crime which is that you never help the government, constantly trying to frustrate it. - Rudolph Giuliani

The thing I would most like to see invented is a way of teaching children and grown-ups the difference between right and wrong. - Robert Maxwell

Stock prices have reached what looks like a permanently high plateau. - Irving Fisher a few weeks before the 1929 crash

Invest in silver and you can never go wrong. - Nelson Bunker Hunt who lost billions after his attempt to corner the silver market went wrong

You are as safe with me as you would be in the Bank of England. - Robert Maxwell

It would have been cheaper to lower the Atlantic. - Lou Grade on the failure of his film 'Raise the Titanic'

You can't run a Church on Hail Marys. - Archbishop Marcinkus

There's always a fear in working class people that all the success and adulation has just been a dream and that you'll wake up tomorrow morning back where you started. - Adam Faith

Achievement: the death of endeavour and the birth of disgust. - Ambrose Pierce

A man is not finished when he is defeated. He is finished when he quits. - Richard Nixon

This tastes like a fart. - Ross Johnson on the tobacco-less cigarette created by his company

When we got into office the thing that surprised me most was to find that things were just as bad as we'd been saying they were. - John F. Kennedy

The road to inflation is paved with good intentions. - William Guttmann

Inflation might be called prosperity with high blood pressure. - Arnold Glasgow

Inflation is a form of taxation that can be imposed with legislation. - Milton Friedman

Inflation isn't an Act of God. High inflation is a man-made disaster, like Southern beer and nylon shirts. - Ronald Long

Lenin was right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. - John Maynard Keynes

I could have made things more difficult but I didn't because I felt a certain responsibility not to destroy the European Monetary System. - George Soros

I am not an expert on the economy. - Norman Lamont

In the world of investment management, it is far better to fail very badly in a conventional way and lose a great deal of money for your client than to lose a little in an unconventional fashion. - Marc Faber

Too many people are apt to redeem their profits too quickly. In a huge bull market they wind up with piddling profits, only to watch their former holdings soar. That usually prompts them into making mistakes later when, believing that the market owes them some money, they buy at the wrong time at much higher levels. - Martin Zweig

Nobody who has ever been on a falling elevator and survived ever approaches such a conveyance without a fundamentally reduced degree of confidence. - Robert Reno after the 1987 crash

If you warn 100 men of possible forthcoming bad news, 80 will immediately dislike you. And if you are so unfortunate to be right, the other 20 will as well. - Anthony Gaubis

Wall Street professionals know that acting on 'inside tips' will break a man more quickly than famine, pestilence, crop failure, political readjustments or what may be called normal accidents. - Edwin Lefevre

A bear market is a financial cancer that spreads. Intermediate rallies (occasionally very strong ones) keep the hopes of investors alive. Furthermore, by continuously publishing bullish reports, brokers and economists, like good nurses, keep the flame of hope from burning out. But after 18 to 36 months of continued losses, total capitulation usually sets in and a major low occurs. - Marc Faber

The crowd always loses because the crowd is always wrong. It is wrong because it behaves normally. - Fred Kelly

There are two times in a man's life when he should not speculate: when he can't afford it and when he can. - Mark Twain

The elements of good trading are cutting losses, cutting losses and cutting losses. - Ed Seykota

Short the industry which the majority of Harvard Business School want to join. - Marc Faber

With enough inside information and a million dollars you can go broke in a year. - Warren Buffett

The secret of life is honesty and fair dealing. If you can fake that, you've got it made. - Groucho Marx

The only thing men learn from history is that men learn nothing from history. - Hegel

Anybody who plays the stock market not as an insider is like a man buying cows in the moonlight. - Daniel Drew 19th century speculator

Never invest in any idea you can't illustrate with a crayon. - Peter Lynch

The market, like the Lord, helps those who help themselves. But, unlike the Lord, the market does not forgive those who know not what they do. - Warren Buffett

You can never go broke by taking a profit. - Meyer Rothschild

Debt is the slavery of the free. - Publius Syrus

If at first you don't succeed try, try again. Then quit. There's no use being a damn fool about it. - W.C. Fields

Never pay the slightest attention to what a company president ever says about his stock. - Bernard Baruch

Take care to sell your horse before he dies. The art of life is passing losses on. - Robert Frost

The ultimate risk is not taking a risk. - James Goldsmith

All the great economic ills the world has known this century can be directly traced back to the London School of Economics. - N.M. Perrera

You could be somewhere where the mail was delayed three weeks and do just fine investing. - Warren Buffett

You don't need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. - Warren Buffett

You go to bed feeling very comfortable just thinking about two and a half billion males with hair growing while you sleep. No one at Gillette has trouble sleeping. - Warren Buffett

If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I’d give it back to you and say it can't be done. - Warren Buffett

Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well. - Warren Buffett

For some reason people take their cues from price action rather than from values. Price is what you pay. Value is what you get. - Warren Buffett

Let's get it clear on what phenomenal wealth is. I think that what Larry Ellison and Bill Gates have is phenomenal wealth. I'm just a two-bit billionaire. - Jim Clarke

Diversification may preserve wealth, but concentration builds wealth. - Warren Buffett

One guy in Thailand in the stock exchange put a gun to his head and said ‘Make the market go up or I’ll shoot myself’. Fantastic. That’s the kind of market I want to be in. - Mark Mobius

If you would like to know the value of money, try to borrow some. - Benjamin Franklin

October. This is one of the peculiarly dangerous months to speculate in stocks. Other dangerous months are July, January, September, April, November, May, March, June, December, August and February. - Mark Twain

When I was young I used to think that money was the most important thing in life. Now that I am old, I know it is. - Oscar Wilde

I owe much; I have nothing; the rest I leave to the poor. - Francois Rabelais

Money can't buy you happiness, but it does bring you a more pleasant form of misery. - Spike Milligan

It is morally wrong to allow a sucker to keep his money. - W.C. Fields

Having a little inflation is like being a little bit pregnant. - Leon Henderson

Money is better than poverty, if only for financial reasons. - Woody Allen

I want a one-armed economist so that the guy could never make a statement and then say 'on the other hand...'. - Harry S. Truman

I was a lousy accountant. I always figured that if you came within eight bucks of what you needed you were doing OK. I made the difference up out of my own pocket. - Bob Newhart

My formula for success is rise early, work late, and strike oil. - Paul Getty

The avoidance of taxes is the only intellectual pursuit that still carries any reward. - John Maynard Keynes

I worked my way up from nothing to a state of extreme poverty. - Groucho Marx

If Graham was alive today, he might argue that you should simply withdraw from the market for a few years until conditions arise which offer you value for money that you are seeking. Graham might be right, but my problem is that I would get so bored waiting. - Jim Slater

I'd be a bum on the street with a tin cup if the markets were efficient. - Warren Buffett on the efficient market hypothesis

I like the directors to own a number of shares substantial enough to give the 'owner's eye', but not so many that they have control, can sit back and could at some stage block a future bid. I like to see a good cross-section of the directors with reasonable shareholdings and I always worry if the Finance Director is not among them. - Jim Slater

Investing without research is like playing stud poker and never looking at the cards. - Peter Lynch

It is quite possible to lose money if a company's accounts follow UK GAAP [Generally Accepted Accounting Practice in the UK] to the letter, but the picture presented is so misleading that you are unable to interpret them correctly and as a result fail to see that it is financially vulnerable or its earnings are unsustainable. - Terry Smith

A company that descends into loss making often succeeds in making a comeback. One which runs out of cash (and friends) rarely has a second chance. - Alan Sugden

What is a cynic? A man who knows the price of everything and the value of nothing. - Oscar Wilde

In the short run, the market is a voting machine. In the long run, it's a weighing machine. - Warren Buffett

There are few worse investments than a growth share going ex-growth. - Jim Slater

The best time to invest is when you have money. This is because history suggests it is not timing which matters, it is time. - John Templeton

Investing in stocks is an art, not a science, and people who've been trained to rigidly quantify everything have a big disadvantage. - Peter Lynch

The tips that pay off sufficiently overshadow the poor overall results for publishers to make a good living out of it. But not, according to my previous calculations, their subscribers. - Mike Mitchell commenting on the effectivenes of stockmarket tipsheets

Speculation is an effort, probably unsuccessful, to turn a little money into a lot. Investment is an effort, which should be successful, to prevent a lot of money becoming a little. - Fred Schwed

Elephants don't gallop. - Jim Slater explaining why he prefers to seek growth oppoprtunties in small cap shares

If your stocks are down 25% in value, isn't it rather absurd to say you're alright because you're getting a 4% yield? - William J. O'Neil

There is no such thing as a paper loss. A paper loss is a very real loss. - Jim Rogers

If the job has been correctly done when a common stock is purchased, the time to sell it is - almost never. - Philip A. Fisher

If you are either a conservative or a very nervous investor, a mechanical system might be smart. It certainly achieves two goals: (1) limiting potential losses and (2) helping you sleep at night. As for maximizing your returns, I think that's another story. - Jonathan Steinberg

The new issue market is ruled by controlling stockholders and corporations who can usually select the timing of offerings. Understandably these sellers are not going to offer any bargains. It's rare you'll find X being sold for half-X. Indeed, in the case of common-stock offerings, selling shareholders are often motivated to unload only when they feel the market is overpaying. - Warren Buffett

An economist is someone who will know tomorrow why the things he predicted yesterday didn't happen today. - Lawrence J. Peter

The optimist sees opportunity in every danger; the pessimist sees danger in every opportunity. - Winston Churchill

If at first you do succeed - try to hide your astonishment. - Harry Banks

If you pay the executives at Sara Lee more, it doesn't make the cheesecake less good. But with mutual funds, it comes directly out of the batter. - Don Phillips on whether paying higher fees for mutual funds results in higher returns

As far as I am concerned, the stock market doesn't exist. It is only there as a reference to see if anybody is offering to do anything foolish. - Warren Buffett

The key to building wealth is to preserve capital and wait patiently for the right opportunity to make the extraordinary gains. - Victor Sperandeo

There is a very important difference between being a theoretical contrarian and dealing with it in practical terms. - Michael Steinhardt

It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong. - George Soros

Basic economic theory suggests that demand falls as prices go up. But in the case of speculative markets, the opposite seems to be true. - Marc Faber

The speculative mania that was hyped in the net rivaled any previous bubble - including the one in 1620 with tulips. It separated a heck of a lot of people from their capital. And it did so permanently. It wasn't just a matter of share prices deviating from value, but rather, in many cases of share prices disappearing and not reappearing. - Mason Hawkins

Chief executives seem no more able to resist their biological urge to merge than dogs can resist chasing rabbits. - Philip Coggan

Technology companies should be valued at a discount to the shares of companies like Disney and Coca-Cola, which have long term earnings. - Bill Gates

Many mergers turn out to be monumental stinkers, with the acquired company sold after an enormous write-off. Putting two drunks together doesn't make a stable person. - Gary Hamel

Having a financial adviser enables the investor to carry a psychological call option. If the investment decision turns out well, the investor takes the credit, and if it turns out badly, the regret can be lowered by blaming the adviser. - Hersh Shefrin

The only time I really ever lost money was when I broke my own rules. - Jesse Livermore

Were there a direct relationship between technological innovation and investment results, then equity returns in the first half of the 19th century should have been spectacular. Alas, they were not. History shows that it is precisely the promise of unlimited technological progress that proves most corrosive to equity returns. - William Berstein

If you're forecasting something, don't promise a specific date. That way, if the date passes, you're not wrong. This has been great advice for me. - Anny Joseph Cohen

You do better to make a few large bets and sit back and wait . . . there are huge mathematical advantages to doing nothing. - Charlie Munger

I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a .400 baseball hitter, but now I want to come back as the bond market. You can intimidate everybody. - James Carville

I have noticed that everyone who ever told me that the markets are efficient is poor. - Larry Hite

Great stocks are extremely hard to find. If they weren't, then everyone would own them. - Philip A. Fisher

The person who knows that he doesn't know much, knows much. - Marc Faber

Diversification is a hedge for ignorance. I think you are much better off owning a few stocks and knowing a great deal about them. - William J. O'Neil

When a chief executive officer is encouraged by his advisors to make deals, he responds much as would a teenager boy who is encouraged by his father to have a normal sex life. It's not a push he needs. - Warren Buffett

I like buying companies that can be run by monkeys - because one day they will be. - Peter Lynch

There are old traders around and bold traders around, but there are no old, bold traders around. - Bob Dinda

One of the trends we have found is that the fund managers that tend to perform the best over time are the ones that tend to spend the least amount of time debating which way the market is heading. - Don Phillips

Conventional wisdom only results in conventional returns. - Mario Gabelli

One of the dumbest things you can do with money is spend it. - Robert Wilson

Buy the stocks of small companies below their economic value, let the companies grow, and resell them as proven successes at full economic value. Individuals often sell small companies below their economic value and buy mature companies at full value, thus providing the other side for our trades. - Ralph Wanger

My approach works not by making valid predictions but by allowing me to correct false ones. - George Soros

The more the theory of efficient markets is believed, the less efficient the markets become. - George Soros

Remember, the price that people agree to in the pit is not the price that people think is going to exist in the future. It's the price that both sides vehemently agree won't be there. - Jeffrey Silverman

When you're feeling manic, you've got to develop the discipline to recognize the internal signs and take the money. And when you're feeling depressed, you've got to avoid jumping out the basement window and buy the market. - Jeffrey Silverman

I think appreciating risk, being aware of it and respecting it, makes you a good trader. It teaches you to be disciplined. Discipline allows you to trade effectively. You can take your ego out of it. You can go wrong 60, 70 percent of the time and still make a lot of money. If you ignore the discipline of managing risk, you have to be right 80 percent of the time or more, and I don't know anyone who's that good. - Larry Rosenberg

Bond investors are the vampires of the investment world. They love decay, recession - anything that leads to low inflation and the protection of the real value of their loans. - Bill Gross

I've always said that a good institutional bond manager has to be one-third mathematician, one-third horse trader, and one-third economist. - Bill Gross

Throughout all my years of investing I've found that the big money was never made in the buying or the selling. The big money was made in the waiting. - Jesse Livermore

Trading has been, and always will be, a hard way to make an easing living. - Jeffrey Silverman

Gamblers and losing traders are typically hooked even stronger than successful traders by virtue of the intermittent nature of the reward. My cat follows me into the kitchen every time I go, yet not once in ten times does he get his turkey snack reward. I suspect that this behavior is practically impossible to extinguish. - Jeffrey Silverman

It's easier to create money than to spend it. - Warren Buffett

I wouldn't mind going to jail if I had three cellmates who played bridge. - Warren Buffett

I don't try to jump over 7-foot bars. I look around for 1-foot bars that I can step over. - Warren Buffett

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently. - Warren Buffett

I wouldn't have been the most popular guy in the class, but I wouldn't have been the most unpopular either. I was just sort of nothing. - Warren Buffett

I'd just bet on him. Nobody has lost money doing that yet. - Warren Buffett when asked what he thought the future held for Bill Gates and Microsoft

Bull markets go to people's heads. If you're a duck on a pond, and it's rising due to a downpour, you start going up in the world. But you think it's you, not the pond. - Charlie Munger

Ben Graham wasn't about brilliant investments and he wasn't about fads of fashion. He was about sound investing, and I think sound investing can make you very wealthy if you're not in too big of a hurry. And it never makes you poor, which is even better. - Warren Buffett on Ben Graham

Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn't do any good to look at the cards. - Warren Buffett on the efficient market hypothesis

If the business does well, the stock eventually follows. - Warren Buffett

When managers want to get across the facts of a business to you, it can be done within the rules of accounting. Unfortunately, when they want to play games, at least in some industries, it can also be done within the rules of accounting. If you can't recognize the differences, you shouldn't be in the equity-picking business. - Warren Buffett

Full-time professionals in other fields, let's say dentists, bring a lot to the layman. But in aggregate, people get nothing for their money from professional money managers. - Warren Buffett

Draw a circle around the businesses you understand and then eliminate those that fail to qualify on the basis of value, good management and limited exposure to hard times. - Warren Buffett

I read annual reports of the company I'm looking at and I read the annual reports of the competitors - that is the main source of material. - Warren Buffett when asked how he determines the value of a business

All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies. - Warren Buffett

Read Ben Graham and Phil Fisher, read annual reports, but don't do equations with Greek letters in them. - Warren Buffett on the necessity of maths in valuing companies

Whenever I read about some company undertaking a cost-cutting program, I know it's not a company that really knows what costs are about. The really good manager does not wake up in the morning and say 'This is the day I'm going to cut costs,' any more than he wakes up and decides to practice breathing. - Warren Buffett

When management with a reputation for brilliance tackles a business with a reputation for poor fundamentals, it is the reputation of the business that remains intact. - Warren Buffett on the importance of investing in a business with good fundamentals

Twenty years in this business convinces me that any normal person using the customary three per cent of the brain can pick stocks as well as, if not better, than the average Wall Street expert. - Peter Lynch

There seems to be an unwritten rule on Wall Street: If you don't understand it, put your life savings into it. Shun the enterprise round the corner, which can at least be observed, and seek out one that manufactures an incomprehensible product. - Peter Lynch

Whoever imagines that the average Wall Street professional is looking for reasons to buy exciting stocks hasn't spent much time on Wall Street. The fund manager most likely is looking for reasons not to buy exciting stocks, so that he can offer the proper excuses if those exciting stocks go up. - Peter Lynch

Between the chance of making an unusually large profit on an unknown company and the assurance of losing only a small amount on an established company, the normal mutual-fund manager, pension-fund manager, or corporate-portfolio manager would jump at the latter. Success is one thing, but it's more important not to look bad if you fail. - Peter Lynch

Gentlemen prefer bonds. - Andrew Mellon

In stocks you've got the company's growth on your side. You're a partner in a prosperous and expanding business. In bonds, you're nothing more than the nearest source of spare change. When you lend money to somebody, the best you can hope for is to get it back, plus interest. - Peter Lynch

The list of qualities [an investor ought to have] include patience, self-reliance, common sense, a tolerance for pain, open-mindedness, detachment, persistence, humility, flexibility, a willingness to do independent research, an equal willingness to admit mistakes, and the ability to ignore general panic. - Peter Lynch

Bonds have one big advantage over stocks that pay paltry dividends or zero dividends . . . They provide their owners a steady return through thick and thin - or, in the case of a bear market, through thin and thinner. - John Rothchild

Governments on six continents are running record deficits and sinking deeper into debt. When all else fails (it always does) they'll rescue themselves with the printing press, making cash worth less and gold worth more. When all currencies lose their credibility, gold will benefit. - John Rothchild

In the stock market, as with horse racing, money makes the mare go. Monetary conditions exert an enormous influence on stock prices. Indeed the monetary climate - primarily the trend in interest rates and Federal Reserve policy - is the dominant factor in determining the stock market's major direction. - Martin Zweig

When ten people would rather talk to a dentist about plaque than to the manager of an equity mutual fund about stocks, it's likely that the market is about to turn up. When the neighbours tell me what to buy and then I wish I had taken their advice, it's a sure sign that the market has reached a top and is due for a tumble. - Peter Lynch on his 'Cocktail Party' theory of market forecasting

If you're considering a stock on the strength of some specific product that a company makes, the first thing to find out is: what effect will the success of the product have on the company's bottom line? - Peter Lynch

If I could avoid a single stock, it would be the hottest stock in the hottest industry, the one that gets the most favourable publicity, the one that every investor hears about in the car pool or on the commuter train - and succumbing to the social pressure, often buys. - Peter Lynch

Although it's easy to forget sometimes, a share of a stock is not a lottery ticket. It's part ownership of a business. - Peter Lynch

If you remember nothing else about p/e ratios, remember to avoid stocks with excessively high ones. A company with a high p/e must have incredible earnings growth to justify its high price. - Peter Lynch

I got positive feelings when I saw that Taco Bell's headquarters was stuck behind a bowling alley. When I saw those executives operating out of that grim little bunker, I was thrilled. Obviously they weren't wasting money on landscaping the office. - Peter Lynch

When you buy a stock for its book value, you have to have a detailed understanding of what those values really are. At Penn Central, tunnels through mountains and useless rail cars counted as assets. - Peter Lynch

If you can find a company that can get away with raising prices year after year without losing customers (an addictive product such as cigarettes fills the bill), you've got a terrific investment. - Peter Lynch

Some people automatically sell the 'winners' - stocks that go up - and hold on to their 'losers' - stocks that go down - which is about as sensible as pulling out the flowers and watering the weeds. Others automatically sell their losers and hold on to their winners, which doesn't work out much better. Both strategies fail because they're tied to the current movement of the stock price as an indicator of the company's fundamental value. - Peter Lynch

If you know why you bought a stock in the first place, you'll automatically have a better idea of when to say goodbye to it. - Peter Lynch

Just because the price goes up doesn't mean you're right. Just because it goes down doesn't mean you're wrong. Stock prices often move in opposite directions from the fundamentals but long term the direction and sustainability of profits will prevail. - Peter Lynch

Our prototype for occupational fervour is the Catholic tailor who used his small savings of many years to finance a pilgrimage to the Vatican. When he returned, his parish held a special meeting to get his first-hand account of the Pope. Tell us said the eager faithful, just what sort of fellow is he?' Our hero wasted no words. 'He's a forty-four medium.'' - Warren Buffett commenting on the characteristics he likes to see in business executives

A good managerial record (measured by economic returns) is far more a function of what business boat you get into than it is of how effectively you row. Should you find yourself in a chronically-leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks. - Warren Buffett

Many corporate managers deplore governmental allocation of the taxpayer's dollar but embrace enthusiastically their own allocation of the shareholder's dollar [to charities of their own choosing]. We've yet to find a CEO who believes he should personally fund the charities favored by his shareholders. Why, then should they foot the bill for his picks? - Warren Buffett

It's probably true that hard work never killed anyone, but I figure why take the chance. - Ronald Reagan

We believe that according the name 'investors' to institutions that trade actively is like calling someone who repeatedly engages in one-night stands a romantic. - Warren Buffett on the difference between investing and speculating

As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one's risk by spreading too much between enterprises about which one knows little and has no reason for special confidence. - John Maynard Keynes

Our reaction to a fermenting industry is much like our attitude toward space exploration: we applaud the endeavour but prefer to skip the ride. Obviously many companies in high-tech businesses or embryonic industries will grow much faster than will The Inevitables [like Coca-Cola and Gillette]. But we would rather be certain of a good result than hopeful of a great one. - Warren Buffett

Loss of focus is what most worries Charlie [Munger] and me when we contemplate investing in a business that looks outstanding. All too often, we've seen value stagnate in the presence of hubris or boredom that caused the attention span of managers to wander. Would you believe that not a few decades back they were growing shrimp at Coke and exploring for oil at Gillette? - Warren Buffett

It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price. Now, when buying companies or common stocks, we look for first-class businesses accompanies by first-class managements. - Warren Buffett

The most common cause of low prices is pessimism - sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism but because we like the prices it produces. It's optimism that is the enemy of the rational buyer. - Warren Buffett

Stocks can't outperform businesses indefinitely. Indeed, because of the heavy transaction and investment management costs they bear, stockholders as a whole and over the long term must inevitably underperform the companies they own. If American business, in aggregate, earns about 12% on equity annually, investors must end up earning significantly less. Bull markets can obscure mathematical laws, but they cannot repeal them. - Warren Buffett

Earnings should only be retained [as opposed to being paid out as dividends] when there is a reasonable prospect that for ever dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors. - Warren Buffett

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity', sing the praises of companies with high share turnover. But investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pickpocket of enterprise. - Warren Buffett

In the search for companies to acquire, we adopt the same attitude one might find appropriate in looking for a spouse: it pays to be active, interested, and open-minded, but it does not pay to be in a hurry. - Warren Buffett

A company that wants to use its own stock as currency for an acquisition has no problems if the stock is selling in the market at full intrinsic value. But suppose it is selling at only half intrinsic value. In that case it is faced with the unhappy prospect of using a substantially undervalued currency to pay for a fully valued property [the negotiated price of the target company]. In effect the acquirer must give up $2 of value to receive $1 of value. Under such circumstances, a marvellous business purchased at a fair sales price becomes a terrible buy. For gold valued as gold cannot be purchased intelligently through the utilization of gold valued as lead. - Warren Buffett

Small is good, micro is not. For the littlest companies, it's like auditioning for the chorus line: one misstep and you're out. I've made it a practice to stay away from the start-ups, the tiny techs, the near-venture-capital situations. I want companies that are established and whose management have proven, at least thus far, that they know how to run a company. - Ralph Wanger

Trying to sell an illiquid stock in a down market brings to mind the galley slaves in Ben-Hur, chained to their bench while the ship sinks. - Ralph Wanger

When people ask how we've managed to get our results [at Acorn], I tell them it's not by avoiding disasters, because I have had my fair share of them. That's understood with small cap investing. But if you manage to own some stocks that go up ten times, that pays for a lot of disasters, with profits left over. - Ralph Wanger

You can't make five or ten or twenty times your money if you don't hold on to stocks. Most people are delighted when a stock doubles, and quickly sell to lock in their gain. If a company is still performing, let its stock, too, continue to perform. - Ralph Wanger

Value stocks have another attraction: they are constantly in fresh production. A new batch often appears when the troubles of a few leaders taint a whole industry. - Ralph Wanger

Deciding on an investment philosophy is kind of like picking a spouse. Do you want someone who is volatile and romantic and emotional, or do you want someone who is steady and trustworthy and down to earth. If you want a successful investment career, you'd better bind yourself to a style you can live with. - Ralph Wanger

The growth of a middle class in developing countries is a very simple - but powerful - way to think about the future. First the newly well-off want bicycles, then motorcycles, and five years from now, automobiles. - Ralph Wanger

Since the Industrial Revolution began, going downstream - investing in businesses that will benefit from new technology rather than investing in the technology companies themselves - has often been the smarter strategy. - Ralph Wanger

The best assurance of continued growth, and high profit margins, comes back to this: the company should have a special niche in the marketplace, so that sales don't depend on offering a commodity item at a lower price than the competition's. It should, to a degree, dominate that niche. The best company in a marginal industry is worth more than the third-best company in a major industry. I'd rather own the shares of Hokuto, the leading mushroom grower in Japan, than of Mitsubishi Motor or Subaru. - Ralph Wanger

Glamour has nothing to do with a niche's appeal. A dull business run by a good businessman is far better than a glamorous business with mediocre management. And even if the glamorous business is run by a genius, often, in that kind of industry, its competitors are also geniuses, so nobody has an advantage, as I've commented about high-tech companies. - Ralph Wanger

Good management to Wall Street means nothing more than a company with three consecutive quarters of rising earnings. Make it four quarters and you have great management. But exciting performance numbers by themselves aren't enough to qualify managers as superior, at least not in my book. One good year or two could be a fluke. Or maybe current management's predecessors set operations up so well that the incumbents haven't had time to wreck everything. - Ralph Wanger

Managements can be guarded, especially if they know we [Acorn fund] own a lot of their stock. But their competitors will usually talk freely about them. It's like trying to find out about a young lady you are interested in. If you ask her mother, you are certainly going to get a different perspective than you would if you asked the boyfriend she has broke up with. We like to hear what the boyfriend has to say. - Ralph Wanger

Without doubt, the most striking feature of the financial era which ended in the Autumn of 1929 was the desire of people to buy securities, and the effect of this on values. But the increase in the number of securities to buy was hardly less striking. And the ingenuity and zeal with which companies were devised in which securities might be sold was as remarkable as anything. - John K. Galbraith

A banker need not be popular. Indeed, a good banker in a healthy capitalist society should probably be much disliked. - John K. Galbraith

No mutual fund manager who relies on market timing has kept his job for fifteen years. Individual investors who try to time the market will be tossed on the same horns. - Ralph Wanger

Nasty bear markets happen every six and a half years. Smaller declines of 10 per cent, called 'corrections', happen every two years or so. Taken together, these minor and major setbacks have produced losses in thirty-three years out of the past one hundred, making investors unhappy roughly one-third of the time. - John Rothchild

It's no accident that the largest investment house in the world, Merrill Lynch, has a bull for a mascot, and took 'Bullish on America' for its corporate motto. No investment house has dared adopt the slogan 'Bearish on America', even during market declines when it might bring in extra business. - John Rothchild

There are few if any chronic bears, as pessimists have a hard time making a living in America. - John Rothchild

Statistics are like prisoners under torture: with the proper tweaking you can get them to confess to anything. - John Rothchild

Buying and holding is far from the sure thing it's made out to be. It works in bull markets. It works if you invest regularly, in dribs and drabs, catching the ups and downs along the way. It works in mild bear markets, when the decline are quickly reversed. It may work if you've got twenty years to wait for stock to recover from a half-off sale. Otherwise, it's risky. It's very risky when you're holding stocks you bought at extravagant prices. It's extremely risky when your retirement depends on a positive result and you're planning to take up golf in a decade or less. - John Rothchild

An investor in a panicky market faces the same predicament as a moviegoer in a crowded theater after somebody shouts 'Fire!' Staying put is the sensible thing to do, as long as everybody else stays put and stays calm. Otherwise, people who stay put run the risk of getting trampled, and people who rush to the exit may have the best chance of escape. - John Rothchild

Bear markets happen for a simple reason. The owners of the merchandise can't get their asking price. The shortage of buyers forces them to lower the fare, until a buyer can be coaxed into making a deal. It's a common occurrence in retail. Stores have a bear market after every Christmas rush. - John Rothchild

That stocks rise and fall on corporate earnings is a much ballyhooed misconception. The price investors will pay for earnings varies from hour to hour, week to week, year to year depending on the inclinations of the buyers and the sellers. - John Rothchild

Outperform your peers in a bull market and you'll be applauded for your skill. Look at Warren Buffett - his popularity grows with his billions. Outperform your peers in a bear market - by turning a profit when they're nursing losses - and check your backside for darts, your rose bushes for poison, and your driveway for nails. On Wall Street a winning bear gets more cold shoulder than an SEC gumshoe. - John Rothchild

Just because a certain asset is out of favor at the moment doesn't guarantee it will turn a profit anytime soon. Gold has been so unpopular for so long it was the star attraction at contrarian conferences dating back to the mid 1980s, when a fervent gold bug lost control of himself, jumped on a chair an hollered ''gold! gold! gold!. At some point gold became so widely ostracised even gold bugs wouldn't buy it. There wasn't a better contrarian play on the planet unless it was mad cow patties and still the price of gold didn't rise.' - John Rothchild

The 1973-1974 collapse, brought the capitalization of the British market down to a mere $50 billion. This was less than the yearly profits of the OPEC oil-producing nations, whose increase in oil prices contributed to the decline in share values. The OPEC nations could have purchased a controlling interest in every publicly traded British corporation at the time with less than one year's oil revenues! - Jeremy Siegel

If Fed Chairman Alan Greenspan were to whisper to me what his monetary policy was going to be over the next two years, it wouldn't change one thing I do. - Warren Buffett

The thing that most affects the stock market is everything. - James Palysted Wood

Many sceptics, it is true, are inclined to dismiss the whole procedure [chart reading] as akin to astrology or necromancy; but the sheer weight of its importance in Wall Street requires that its pretensions be examined with some degree of care. - Benjamin Graham

How can institutional investors hope to outperform the market when, in effect, they are the market? - Charles Ellis

The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us when the storm is long past, the ocean will be flat. - John Maynard Keynes in 'A Tract on Monetary Reform', 1924

If you can't control your emotions, being in the market is like walking into a heated area wearing a backpack full of explosives. - Charles Ellis

Sex is one of the most wholesome, beautiful and natural experiences that money can buy. - Steve Martin

A pin lies in wait for every bubble and when the two eventually meet, a new wave of investors learns some very old lessons. - Warren Buffett

Like bidets, you're not quite sure what they're for, but they add a touch of class. - Michael Grade on the role of non-executive directors

Innovation! One canot be forever innovating. I want to create classics! - Coco Chanel

It's an old joke, but worth retelling that 'emeritus' is a Latin word. E means he's out and meritus means he deserves it. - Neil Bennett on Sir Iain Vallance's new chairman emeritus title at BT

Negotiation is the art of letting the other side have your way. - Daniel Vare

As times get harder, words grow more weaselly. Euphemisms boom in a recession, even if nothing else does. - Alison Eadie

If you want to be a success in the world, promise everything and deliver nothing. - Napoleon Bonaparte

Without economy none can be rich and with it few will be poor. - Samuel Johnson

The successful man is one who makes more than his wife can spend. And the successful woman is one who can find such a man. - Bienvenida Buck

There are three kinds of economists. Those that can add, and those that can't. - Hamish McRae

All paid employments absorb and degrade the mind. - Aristotle

I made my money by selling too soon. - Bernard Baruch

For me, the richness is in the learning. - Allan Leighton remarking on the continuing fall in value of his shareholdings in lastminute.com

Investors may be quite willing to take the risk of being wrong in the company of others, while being much more reluctant to take the risk of being right alone. - John Maynard Keynes

Markets can remain irrational longer than you can remain solvent. - John Maynard Keynes

I think a lot of people initially thought that the 'e' in e-business was more important than the business. - Michael Dell

Each time, it's a nice little company, nice people, modestly successful. Then you bring in the VC money - it's like putting jet engines on a VW. They expect that, within a year and a half, they will get back ten times their money . . . It runs up against the laws of physics. It's like putting nine women together and trying to make a baby in one month. - Dennis Faust

I don't think it's terribly interesting how much money I give to charity because I have not solved any diseases yet. Until you do, what difference does it make? - Larry Ellison

One reason why bubbles swell up and go pop is that investment managers all puff and blow at the same time. - Christopher Fildes

We are not a stock that you can sleep well with at night. We are a volatile stock . . . For a short-term investor, or for a small investor, I wouldn't invest in internet stocks. - Jeff Bezos

A fully fledged economic downturn will cause nastier things to come out of the woodwork. The old market saying is: 'Recessions uncover what auditors do not.' - Philip Coggan

Share prices follow the theorem: hope divided by fear minus greed. - Dominic Lawson

We have embraced the 21st century by entering such cutting-edge industries as brick, carpet, insulation and paint. Try to control your excitement. - Warren Buffett

The art of taxation consists in plucking the goose to obtain the largest amount of feathers with the least amount of hissing. - Jean-Baptiste Colbert

It is inconceivable that anyone will divulge a truly effective get-rich scheme for the price of a book . . . There is ample opportunity to use wealth in this world, and neither I nor my friends, nor anyone else I have ever met, has so much of it that they are interested in putting themselves at a disadvantage by sharing their secrets. - Victor Niederhoffer

A good bet is that all systems will stop working when you use them. - Victor Niederhoffer

If a man is both wise and lucky, he will not make the same mistake twice. But he will make any one of ten thousand brothers or cousins of the original. The mistake family is so large that there is always one of them around when you want to see what you can do in the fool-play line. - Edwin Lefevre

When you win, you eat better, you sleep better, your beer tastes better, and your wife looks like Gina Lollobrigida. - Johnny Pesky

Investors are slow to learn that security analysts do not always mean what they say. - Hersh Shefrin

As incumbents seek to increase the concentration of industry power, newcomers plot ways to dilute it. While dinosaurs merge, upstarts race toward the future. Bulk is no bulwark against the onslaught of revolutionary new competitors. And it's hard to mate and run at the same time. - Gary Hamel

Too many mergers resemble the marriage of two cripples who become twice as old, twice as bureaucratic and twice as undynamic. - Peter Drucker

Select stocks the way porcupines make love - very carefully. - Bob Dinda

Inherited wealth is a big handicap to happiness. It is as certain death to ambition as cocaine is to morality. - William Vanderbilt

Dealmaking beats working. That's why there are deals that make no sense. - Peter Drucker

Being in power is like being a lady. If you tell people you are, you aren't. - Margaret Thatcher

The common idea that success spoils people by making them vain, egotistic and self-complacent is erroneous; on the contrary, it makes them for the most part humble, tolerant and kind. Failure makes people cruel and bitter. - W. Somerset Maugham

Common sense is not so common. - Voltaire

Driving a car involves a foot on the gas, hands on the wheel, and eyes on the road. Navigating on the bond markets requires a foot on interest rates, a handle on the prospects of being repaid, and an eye on inflation. - Steven Mintz

People should be more concerned with the return of their principal than the return on their principal. - Jim Rogers

I want the whole of Europe to have one currency; it will make trading much easier. - Napolean Bonaparte

The management of stock exchange investments is a kind of low pursuit from which it is a good thing for most members of society to be free. - John Maynard Keynes

I would rather see finance less proud and industry more content. - Winston Churchill

Statistics are like a bikini. What they reveal is suggestive, but what they conceal is vital. - Aaron Levenstein

There are few ways in which a man can be more innocently employed than in getting money. - Samuel Johnson

The one thing that hurts more than having to pay income tax is not having to pay income tax. - Thomas Duwar

The race is not always to the swift, nor the battle to the strong, but that's the way to bet. - Damon Runyon

If, after half an hour, you haven't figured out who the patsy is, then you're the patsy. - Warren Buffett on shares and poker

Do you know the only thing that gives me pleasure? It's to see my dividends coming in. - John D. Rockefeller

I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years. - Warren Buffett

There are two classes of forecasters: those who don't know, and those who don't know they don't know. - John K. Galbraith

Either they're trying to con you or they're trying to con themselves. - Warren Buffett on financial analysts

Playing the stock market is analogous to entering a newspaper beauty-judging contest in which one must select the six prettiest faces out of a hundred photographs, with the prize going to the person whose selections most nearly conform to those of the group as a whole. - John Maynard Keynes

The gambling known as business looks with austere disfavor upon the business known as gambling. - Ambrose Pierce

In a difficult business, no sooner is one problem solved than another surfaces - never is there just one cockroach in the kitchen. - Warren Buffett

640k ought to be enough for anybody. - Bill Gates

I look for businesses in which I think I can predict what they're going to look like in ten to fifteen years time. Take Wrigley's chewing gum. I don't think the internet is going to change how people chew gum. - Warren Buffett

La rentabilidad por dividendo NO existe

Soy consciente que incluso en webs financieras prestigiosas se habla de ese término mítico “rentabilidad por dividendo”. Esto demuestra, una...

-

Con este desafortunado título sumado a una desafortunada portada, Ángel Matute y Miguel Larrañaga presentan un libro serio que es a la vez u...

-

Net Worth Calculated March 2012 Rank Name Net Worth Age Source Country of Citizenship 1 Carlos Slim Helu & family $69 ...

-

En una ocasión un famoso alquimista escribió una obra titulada “Crisopeya o arte de fabricar oro” y se la presentó al papa León X, dando por...